Have you ever noticed those patterns that look like funnels on the charts? Let's dive into the fascinating world of wedges in trading, a tool that can offer intriguing clues about upcoming market moves.

What are Wedge Patterns?

Wedges are like those moments when the price seems to be squeezed between two converging lines. Imagine squeezing a tube of toothpaste – pressure builds until something inevitably has to give.

Main Features

Convergence of trend lines

Typical duration of 1 to 3 months

Volume tends to decrease during its formation

Clear breakout once the pattern is complete

Key Elements of a Wedge

Two trend lines coming together

General direction of movement

Decreasing volume

Defined breakout point

Types of Wedges

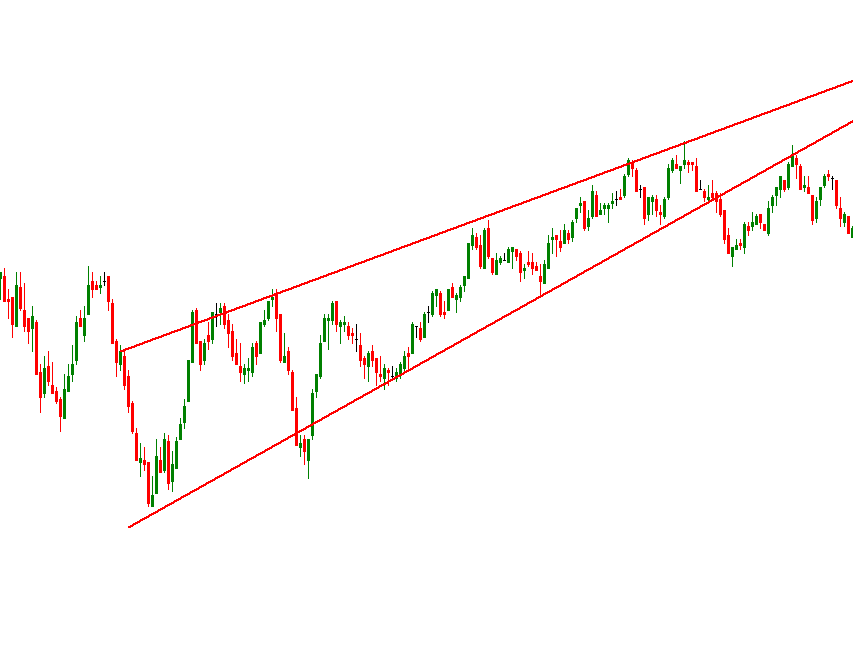

Rising Wedge

Think of a narrowing ramp as it climbs. The price rises but with decreasing strength, like a runner getting tired on an uphill slope.

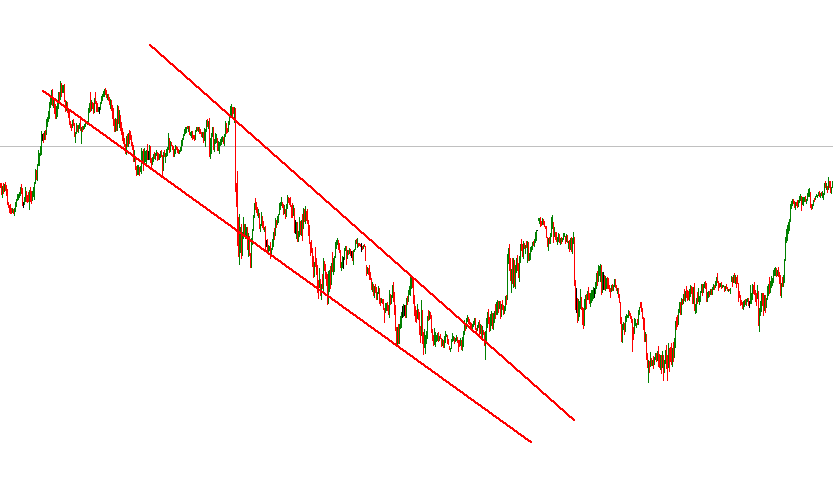

Descending Wedge

It's like a slide that narrows. The price falls, but sellers gradually lose momentum.

Differences Between Rising and Descending Wedges

Direction of movement

Opposite exhaustion signals

Different target prices

Specific volume behavior

Identifying Wedge Patterns

How to Recognize a Wedge on the Chart

Observe the convergence of the lines

Look for at least 3 contact points on each line

Confirm the previous trend

Analyze volume behavior

Characteristics of a Valid Wedge

Proper angle of convergence

Minimum formation duration

Adherence to trend lines

Volume consistent with the pattern

Common Mistakes in Identification

Confusing with triangles

Not waiting for confirmation

Ignoring market context

Rushing into entry

Trading with Wedges

Strategies for Rising Wedges

Wait for the breakout of the lower line

Confirm with volume

Set a stop loss above the last resistance

Define realistic price targets

Strategies for Descending Wedges

Wait for the bullish breakout

Verify the increase in volume

Set stop loss below the last support

Project targets based on the pattern's size

Risk Management in Wedge Trades

Minimum risk/reward ratio of 1:2

Use of dynamic stops

Position size adjusted

Defined exit plan

Relation with Other Patterns

Triangles vs. Wedges

Wedges have a clear tilt, while triangles are usually more symmetrical.

Continuation and Reversal Patterns

Wedges can act as both, depending on the context and their formation.

Wedges in Different Timeframes

Their reliability varies depending on the timeframe, being more relevant in longer periods.

Frequently Asked Questions

Why is a Rising Wedge Bearish?

It shows a gradual depletion of buyers despite the upward movement.

Why is a Descending Wedge Bullish?

It indicates that sellers are losing strength, setting the stage for a rebound.

Reliability of Wedge Patterns

The effectiveness is around 60-70%, increasing with volume confirmation and favorable context.

Are you ready to identify wedges on your charts? Remember that practice makes perfect, and each pattern is an opportunity to learn something new about the market.