What is the Fibonacci Retracement?

Fibonacci Retracement is a technical analysis tool that uses ratios derived from the Fibonacci sequence to identify potential support and resistance levels on price charts.

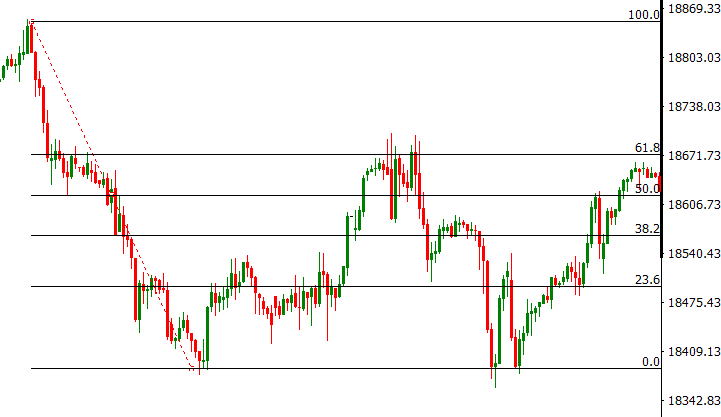

Understanding Fibonacci Levels in Trading

The most important levels are: 23.6%, 38.2%, 50%, 61.8% and 78.6%.

How are Fibonacci Retracement levels calculated?

Levels are calculated by taking two extreme points on a chart (usually a minimum and maximum) and dividing the vertical distance by the key Fibonacci ratios.

Formula for calculating Fibonacci Retracements

Retroceso = Precio Máximo - (Precio Máximo - Precio Mínimo) * Ratio de FibonacciHow to use Fibonacci Retracements in trading?

Identify the trend

First, identify the general trend: bullish or bearish. Retracements are used to look for opportunities in the direction of the prevailing trend.

Plotting Fibonacci levels

Select the Fibonacci Retracement tool in your platform and plot from a low to a high in an uptrend, or from a high to a low in a downtrend.

Observing price reactions at key levels

Look for bounce or breakout signals at Fibonacci levels. A bounce may signal a continuation of the trend, while a breakout a possible reversal.

Combine with other indicators

Confirm Fibonacci signals with other technical indicators such as moving averages, RSI or MACD to be more confident in your trades.

Examples of Fibonacci Retracements

Frequently Asked Questions about Fibonacci Retracements

What are the most important Fibonacci levels?

Traders tend to pay more attention to the 38.2%, 50% and 61.8% levels.

Can Fibonacci Retracements be used in all timeframes?

Yes, retracements work on all time frames, from minute to monthly charts. Choose according to your trading style.

Do Fibonacci Retracements always work?

No, no tool is infallible. Fibonacci retracements offer possible support/resistance zones but the price does not always react as expected. Use stop loss and manage risk.