Program Rules

What rules must I follow once I become a funded trader at Noctorial?

Learn the three essential rules in the Noctorial Trader Program: consistency, exposure management, and risk control when withdrawing profits.

At Noctorial, we are not looking for traders who get lucky with a trade. We seek traders who are consistent, responsible, and able to manage capital as if it were their own.

That is why, once you pass the evaluation phase, you become a Certified Noctorial Trader and must adhere to three key rules during the Program:

1. No trade can represent more than 25% of the total profit you wish to withdraw.

This ensures that your results do not rely on a single isolated trade. We want you to earn from trading consistently, not from a stroke of luck.

That is, the value of any successful trades must never exceed 25% profitability when requesting a withdrawal. In such cases, trades exceeding this percentage will not be considered valid.

Example: If you are withdrawing €1,000, no individual trade can have a profit greater than €250 when you request the profit withdrawal.

2. Maximum Risk Limit of 3% per Strategy. This is the fundamental risk management rule. A maximum risk limit of 3% per trading strategy is set. You cannot expose more than 3% of your total account capital to the market in a single day. If you maintain several open trades, the total combined risk of all of them must not exceed this limit.

For control purposes, any trade or set of trades sharing the same logic or technical analysis (for example, several purchases on NASDAQ with the same analysis) is considered a trading strategy.

Breach of this rule is considered a Prohibited Practice.

3. You must maintain consistency in the number of trades and lot sizes.

In trading, the lot is the unit that defines the size of a trade. It is not the same to open a trade with 0.10 lots as with 1.00 or 5.00: the larger the lot, the greater the volume of money you are moving… and also the greater the risk.

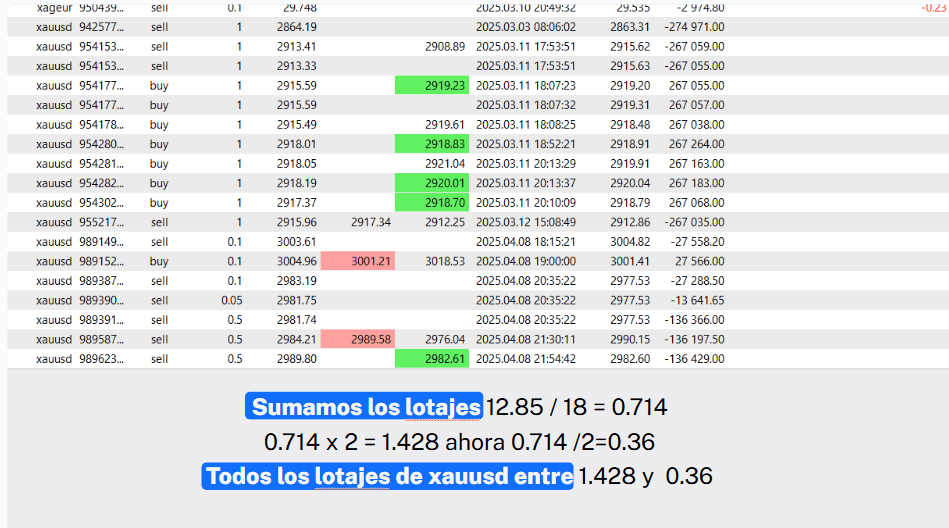

Therefore, at Noctorial, we analyze the average number of trades you make with each symbol (for example, EURUSD or XAUUSD) and the average size of your lots.

This allows us to see if you are trading with judgment or improvising based on your previous result.

We establish a healthy range:

Maximum allowed: double the average

Minimum allowed: half the average.

This helps you maintain stability in your risk management and avoid impulsive decisions.

Example:

Do I bear the losses if I fail on a funded account at Noctorial?

What are the rules of the evaluation process for the funding program?