What are order blocks in trading?

An order block refers to an area on the chart where there has been a large accumulation of buy or sell orders by institutional market participants.

These zones often act as key support or resistance levels later on, as the price tends to react to them due to the interests of the "strong hands".

Why order blocks are important in technical analysis

The reason order blocks are relevant is that they mark points where the market made a sharp move driven by a large volume of orders. When the price returns to these areas, a reaction is expected as there may still be pending orders to be filled. Therefore, order blocks provide us with context about previous market activity that we can use to our advantage.

Types of order blocks

The order block types are as follows:

- Bullish.

- Bearish.

- Mitigation.

Bullish order blocks (bullish order blocks)

Bullish order blocks are formed when there is strong buying that drives the price sharply higher. This usually happens after a previous fall, and the order block serves as support where institutional investors are expected to buy if the price moves back to that area.

Bearish order blocks (bearish order blocks)

On the contrary, bearish order blocks are left after a strong sell-off that knocks the price down. If the price rises back to the bearish order block zone, it is expected to act as a resistance where strong hands will place their sell orders.

Order mitigation blocks

Mitigating order blocks are those that form within a trend, temporarily slowing the price movement but not reversing it. They can lead to pull-backs and be used to join the trend.

How to identify and mark an order block?

Techniques and strategies to detect order blocks

To find order blocks, look for candlesticks with large bodies and small or non-existent shadows that stand out from previous candlesticks. They usually have more volume. The subsequent candlestick is also important, as it confirms that all the volume of the order block was absorbed. The key is the market context.

Use of indicators and tools for marking order blocks (example: order block indicator mt4)

You can use custom indicators to automatically mark order blocks on your charts. For example, there is the order block indicator for MetaTrader 4. However, it is best to learn how to visually identify them yourself.

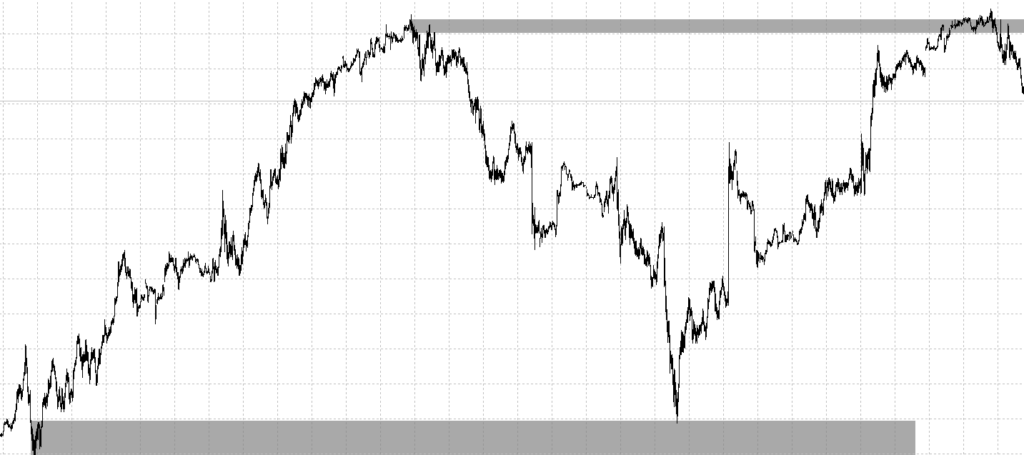

Graphical examples of order blocks

Attach images of real charts showing examples of bullish, bearish and mitigating order blocks. Mark the order blocks with boxes and include explanatory annotations.

Operating with order blocks

Trading strategies based on order blocks

A simple strategy is to wait for the price to return to the area of an order block and open a position in the direction of the previous momentum once the rebound is confirmed. The order block is used to place stop losses behind it and take profits can be placed at other relevant points on the chart.

Risk management when trading with order blocks

As in any strategy, risk control is key. Always use stop losses to limit your losses in case the price does not react as expected in the order block. Adjust the size of your positions according to your risk-reward ratio and do not risk more than 2% of your account per trade.

Combining order blocks with other trading concepts (supports, resistances, trends, etc.)

Order blocks work best in combination with other elements of technical analysis such as support/resistance, trends or chart patterns. Always look for confluence between several factors to increase the probability of success of your trades.

Order blocks in different markets

Order blocks in Forex

In the forex market, order blocks are very useful given the high volume traded and the presence of large institutional participants. Pairs such as EUR/USD, GBP/USD or USD/JPY often have highly respected order blocks.

Applying order blocks in cryptocurrency trading

Cryptocurrencies are more influenced by retail sales, but order blocks from large investors still mark key points. As a more volatile market, movements from order blocks can be explosive.

Order blocks in the stock market

Although volume varies from stock to stock, order blocks are equally valid for finding support and resistance zones. Pay special attention to order blocks formed after important company news or results.

Common mistakes when trading with order blocks

Misinterpreting or forcing order blocks

Not all large candles with high volume are valid order blocks. Avoid forcing order blocks where there is no clear context or confluence with other technical patterns. Being too subjective in identifying order blocks leads to false signals.

Failure to use an adequate stop loss

Placing the stop loss too close to the order block is a mistake, as the price often makes spikes that sweep those stops before bouncing back. On the other hand, a stop too wide negatively affects your risk-return ratio. Look for a balance according to the volatility of the asset.

Operating without confluence of other factors

Attempting to trade based on order blocks alone and disregarding other elements of analysis is ineffective. Order blocks work best as part of a system that includes more technical factors.

Conclusions

Recapitulation of key concepts

Order blocks are areas where a high volume of institutional orders accumulate and then act as support or resistance. They can be identified by candlesticks with large bodies and little subsequent movement. There are bullish, bearish and mitigation order blocks.

The importance of mastering order blocks in trading

Knowing how to spot and trade based on order blocks gives you an edge in trading, as it allows you to trade in areas where strong hands are likely to enter. Combining order blocks with other patterns improves your chances of success.

Never stop learning and improving your operations

Trading is a continuous process of learning and improvement. Mastering the order blocks is a big step, but you need to keep training and incorporating new techniques and concepts to progress as a trader. Practice and experience are key to becoming a consistently profitable trader.