The world of trading is filled with fascinating tools, and today we are going to dive into one of the most interesting: the Trailing Stop. If you’ve ever wondered how to automatically protect your profits while the market moves in your favor, you’re in the right place.

How the Trailing Stop Works

What is a Trailing Stop and What is it Used For?

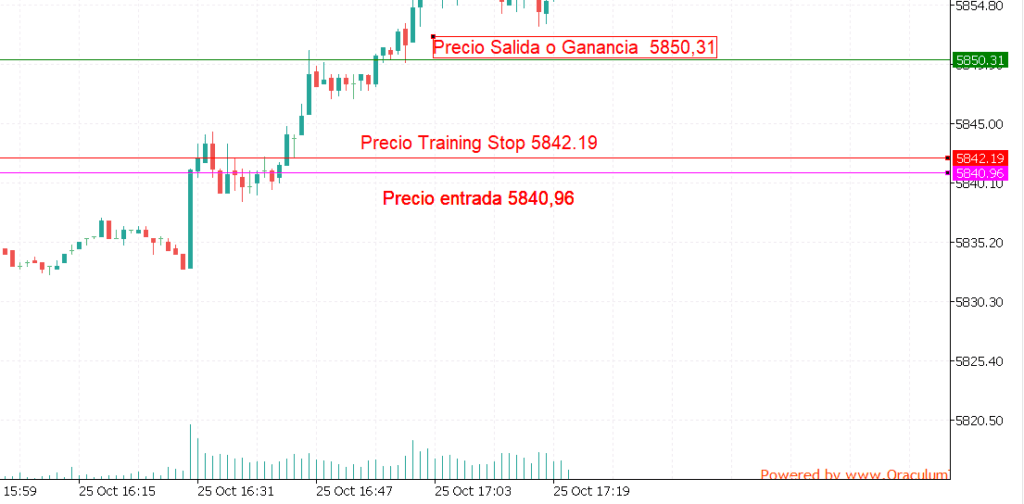

The Trailing Stop is like having a personal bodyguard for your trades. Imagine an order that automatically adjusts while the price moves in your direction, always maintaining a fixed distance that you determine. It's essentially a dynamic stop order that ‘chases’ the price, protecting you from sudden market changes.

Differences Between Trailing Stop and Traditional Stop Loss

The traditional Stop Loss is like a line in the sand that doesn't move, whereas the Trailing Stop is more like a shadow following the price. The main difference lies in its adaptability: while the Stop Loss stays fixed at one level, the Trailing Stop adjusts automatically when the market moves in our favor.

How Does a Trailing Stop Order Work?

Let's take a simple example: you buy a stock at €100 and set a Trailing Stop at 5%. If the price rises to €110, your stop will automatically adjust to €104.5 (5% below). If the price continues to rise, the stop will keep moving upward, but if it falls, the stop will remain at its last highest level.

Implementation of Trailing Stop on Different Platforms

How to Set Up Trailing Stop on Binance

On Binance, you can activate the Trailing Stop from the trading window:

Select “Trailing Stop” in the order type

Define the trigger distance

Set the tracking percentage

Setting on MetaTrader 5 (MT5)

MT5 allows you to set the Trailing Stop in points:

Right-click on the open trade

Select “Trailing Stop”

Choose the distance in points

Using Trailing Stop on Interactive Brokers

Interactive Brokers offers advanced options:

Percentage-based Trailing Stop

Fixed amount Trailing Stop

Activation time Trailing Stop

Advantages and Disadvantages of Trailing Stop

Main Benefits of Trailing Stop

Automatic profit protection

Allows profits to run

Reduces emotional burden in trading

Optimizes time management

Limitations and Risks to Consider

May exit trades prematurely in volatile markets

Not effective in sideways ranges

Requires precise configuration based on the asset

Strategies and Best Practices

When to Use Trailing Stop?

The Trailing Stop shines particularly in:

Strong and defined trends

Long-term trades

Markets with moderate volatility

Recommended Percentages for the Trailing Stop

Percentages vary based on the asset:

Forex: 1-2%

Stocks: 3-5%

Cryptocurrencies: 5-10%

Tips to Maximize Effectiveness

Adjust the trailing according to the asset’s volatility

Combine it with technical analysis

Test different settings in demo first

Practical Examples of Trailing Stop

Case Study in Bullish Trades

In a bullish Bitcoin trend:

Entry: $30,000

Trailing Stop: 7%

Outcome: Exit at $42,000 after a 7% drop from a high of $45,000

Application in Bearish Markets

In short positions, the Trailing Stop moves down:

Short entry: $100

Trailing Stop: 5%

Exit: $85 after a 5% increase from lows

Frequently Asked Questions About Trailing Stop

Most Common Configurations

What distance is best?

It depends on your trading style and the asset

Can it be used in all markets?

Yes, but its effectiveness varies

Does it work in scalping?

It's not recommended due to volatility

Common Problems and Solutions

Premature exits: Increase trailing distance

Missed opportunities: Adjust according to volatility

Erroneous activation: Verify your platform settings

Remember that the Trailing Stop is just one tool in your trading arsenal. Its effectiveness will depend on how you integrate it into your overall strategy and your understanding of the market.